Moneybox has secured 23rd position in Deloitte’s UK Technology Fast 50, marking its fifth consecutive appearance in the rankings and reflecting the platform’s expanding presence in the UK retail investment sector.

The company, which provides services including stocks and shares ISAs, lifetime ISAs and pension products, recorded revenue growth of 1,399% over the past three years. This growth trajectory coincides with Moneybox surpassing £10 billion in assets under administration (AUA) – a key metric that measures the total value of assets a financial institution manages on behalf of clients. The platform’s momentum accelerated in the third quarter of 2024, with £615 million in net deposits – representing capital flowing into the platform minus withdrawals – marking a 143% increase compared to the same period in 2023. During this period, Moneybox attracted 72,000 new customers, expanding its user base across various investment products.

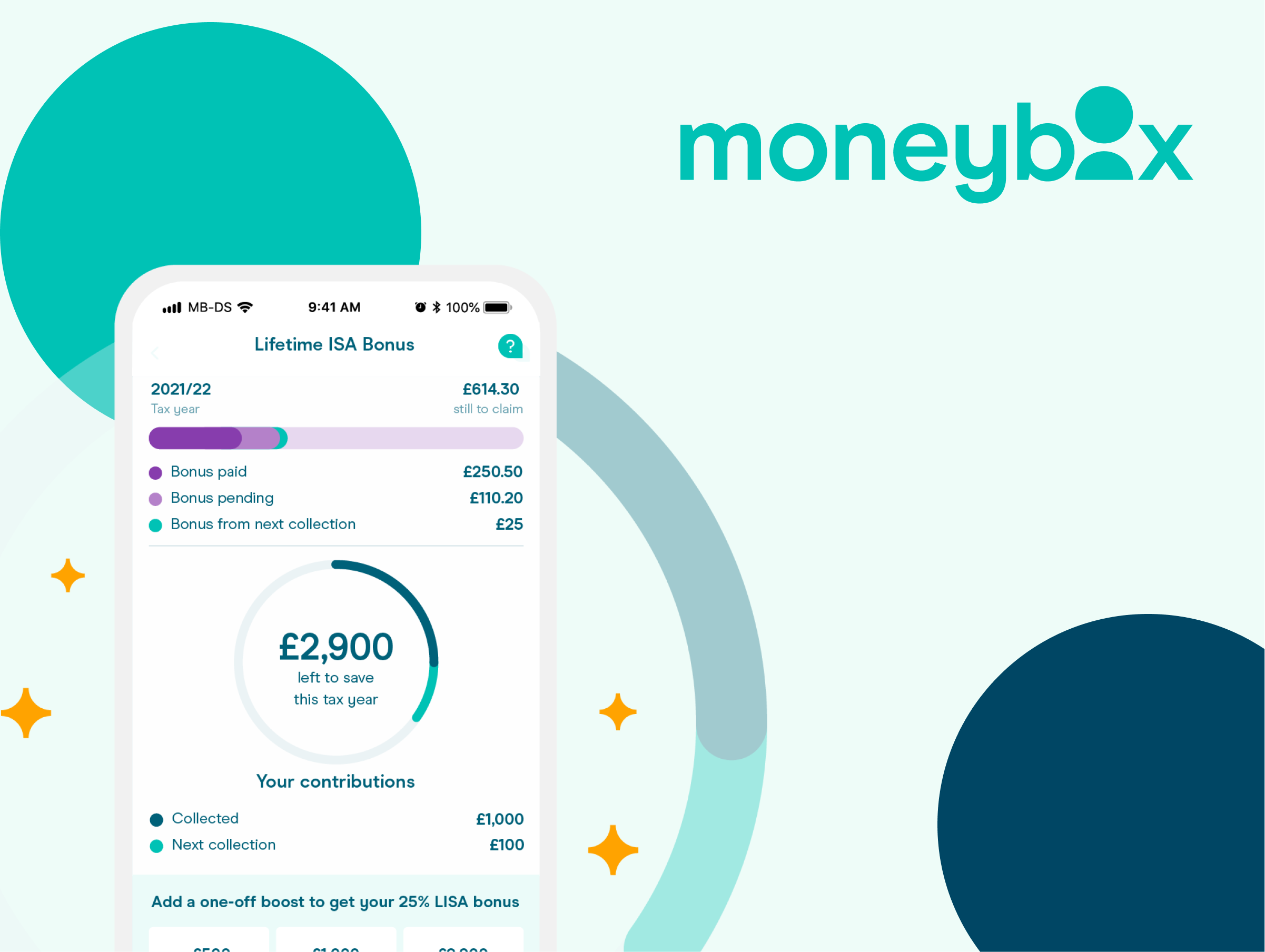

Ben Stanway, Co-Founder and Executive Chair of Moneybox, says: “Over the past decade, our dedicated team has built a vertically integrated proprietary tech platform and a radically customer-centric experience where people don’t have to have wealth to create wealth.” The wealth management sector has seen increasing competition from digital-first platforms that aim to make investing more accessible to retail customers. These platforms typically offer lower minimum investment amounts and reduced fees compared to traditional wealth managers, who often require significant minimum investments and charge higher management fees.

Moneybox’s growth suggests it is capturing market share in this evolving landscape. The platform’s expansion comes as traditional financial institutions invest in digital capabilities to compete with fintech challengers. The increase in assets under administration per customer suggests Moneybox is successfully cross-selling products across its user base. “Today, we’re proud to serve over one million customers, helping them achieve their financial goals and build wealth with confidence. Our customers increasingly demonstrate that they want to use us for their wealth-building needs throughout life,” Ben says. The wealth management market continues to evolve as digital platforms introduce new products and services. Moneybox’s growth trajectory suggests it is well-positioned to capture additional market share as retail investors increasingly embrace digital investment platforms. “We believe Moneybox has a clear pathway to becoming a category-defining business, given the market opportunity, our differentiated focus, and the deeply embedded value in our customer base,” Ben says.